Buying Smart: Unlocking Homeownership with the 28/36 Rule That Separates Smart Buyers from Stressed Owners

Make your new home purchase a blessing—not a lifetime burden.

Buying a home is one of life’s biggest milestones. But too often, buyers get swept up in the excitement and overlook a critical rule that can derail their dreams at the last minute. It’s called the 28/36 rule, and it’s the silent gatekeeper of mortgage approval.

The Hidden Gatekeeper: The 28/36 Rule

Before lenders approve your mortgage, they run the numbers:

-

28% Rule: Your monthly housing costs (mortgage, taxes, insurance, HOA) must not exceed 28% of your gross monthly income.

-

36% Rule: Your total monthly debt—including housing, car loans, student loans, and credit cards—must stay below 36% of your gross income.

Even if you feel financially ready, this rule can quietly block your approval. And most people don’t hear about it until it’s too late.

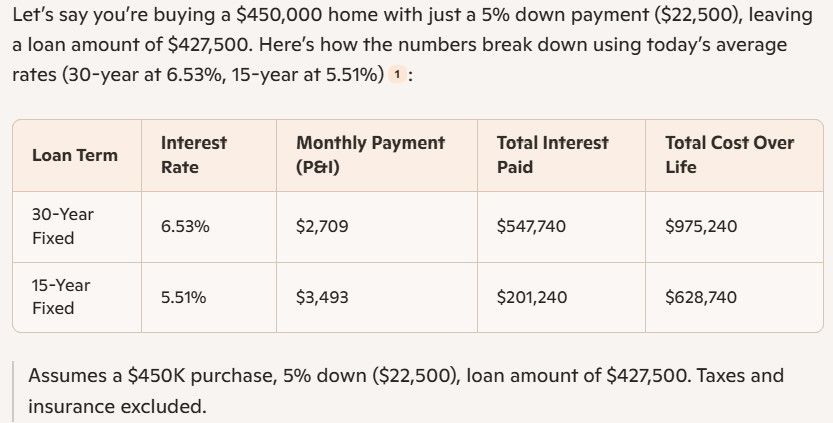

15-Year vs. 30-Year Mortgage with 5% Down: Blessing or Burden?

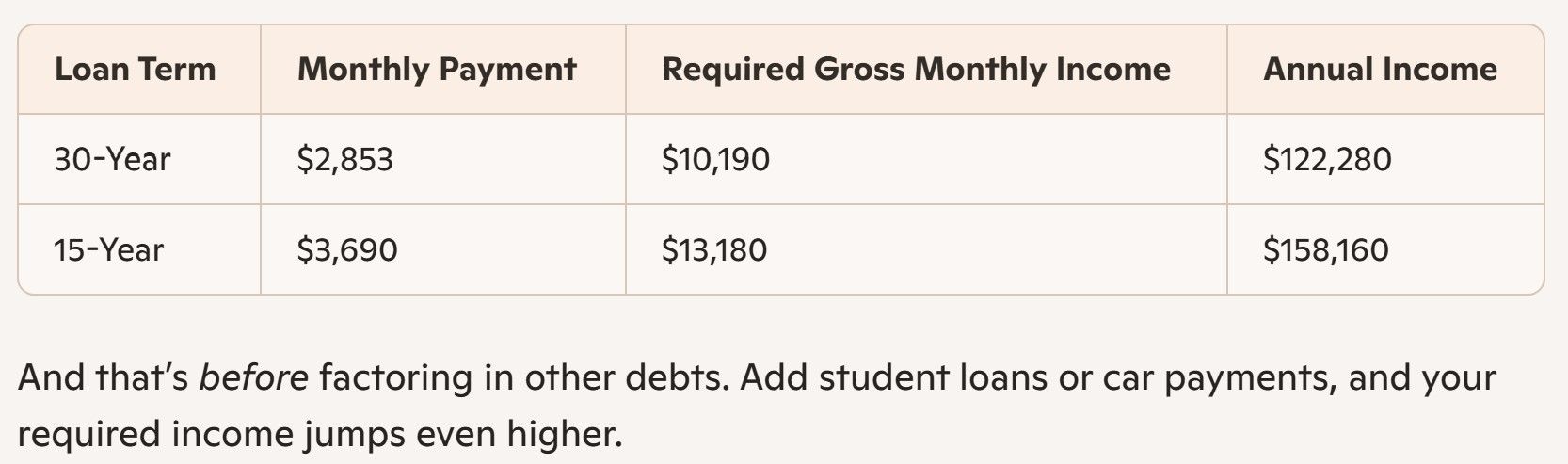

Income Needed to Qualify (28% Rule)

|

|

|||

|---|---|---|---|

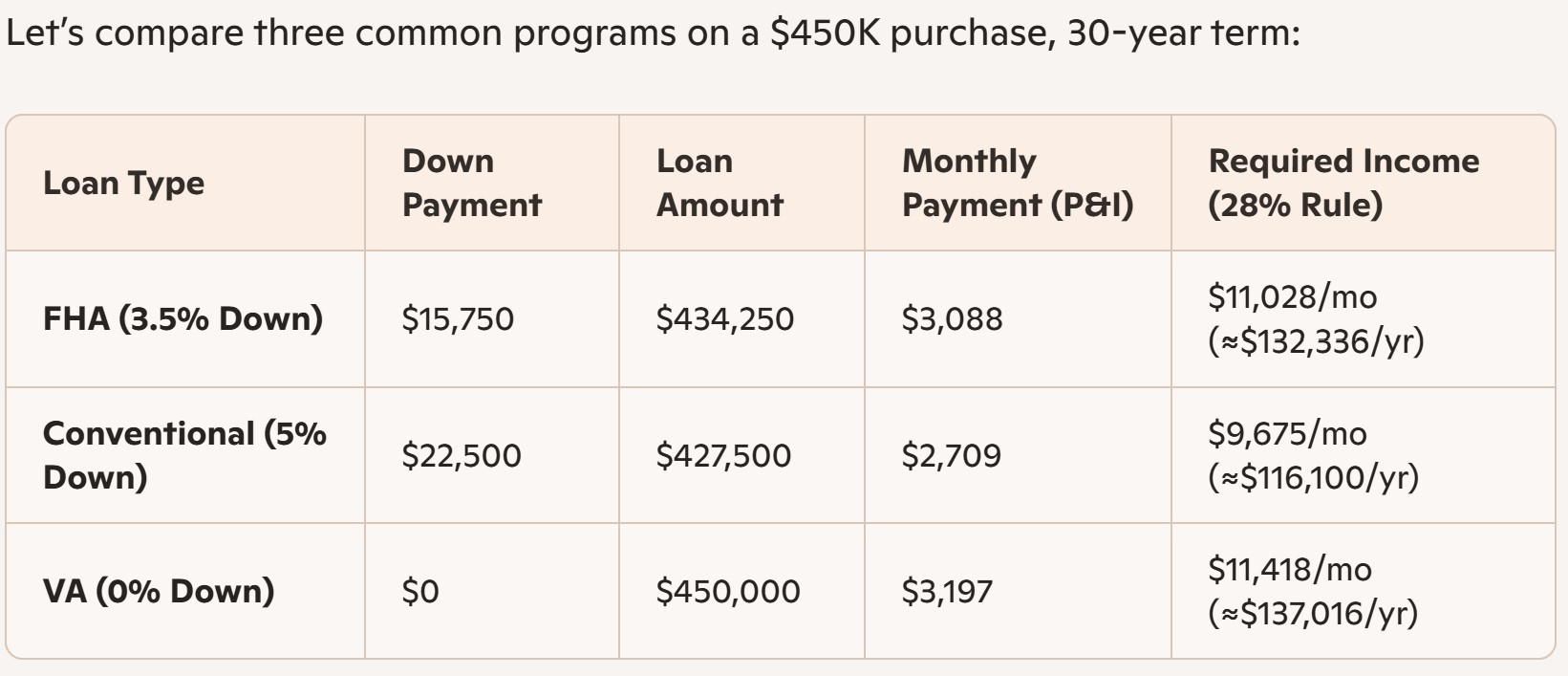

FHA, Conventional, and VA Loans: How They Stack Up

Conventional based on 5% down (vs. typical 20%), 30-year at 6.53%. VA payment excludes PMI but reflects full loan amount.

The “Too Late” Trap

Many buyers get pre-approved for a 30-year loan, then decide to switch to a 15-year term—only to discover the higher payment pushes them past the 28% housing cap. Suddenly they no longer qualify, despite excellent credit and a healthy savings reserve.

How to Stay Ahead

-

Run the numbers early—don’t wait for underwriting.

-

Choose your loan term wisely—shorter isn’t always better if it breaks the 28/36 rule.

-

Factor in all debts—not just the mortgage.

-

Talk to multiple lenders—some offer more flexible DTI limits or specialized programs.

Final Thought

Buying a home isn’t just about what you want—it’s about what the math allows. The 28/36 rule is the math that matters most. Before you fall in love with a house, fall in love with your financial reality first.

Want help calculating your numbers or comparing loan options with your home purchase? We got your back—let the Quillie Real Estate Team make your home purchase a blessing and a good investment, not a burden.

NEVER UNDERESTIMATE THE VALUE

Categories

Recent Posts

GET MORE INFORMATION